Rethinking Bioactive Peptides: From Raw Commodity to Differentiated Ingredient

Bioactive peptides are no longer just another line item on a raw-materials spreadsheet. As functional nutrition markets mature, purchasers, R&D teams and brand marketers are asking for ingredients that deliver reproducible efficacy, regulatory clarity, and formulation-friendly performance. This is the moment for peptide suppliers and B2B customers to upgrade their approach: move beyond “commodity” pricing toward “specialty” value built on science, quality systems, and application support.

Understanding Bioactive Peptides: Functions, Sources & Market Drivers

At a technical level, bioactive peptides are short amino-acid chains derived from larger parent proteins that exert specific physiological effects after absorption or local action in the gut. Their known activities include antihypertensive, antioxidant, anti-inflammatory, immune-modulatory and gut-health effects, among others. Sources range from dairy and egg proteins to plant proteins (soy, pea), marine proteins and fermentation-derived peptides; production methods include controlled enzymatic hydrolysis, microbial fermentation and downstream fractionation. [1] citeturn0search19

Market drivers pushing peptides from commodity into specialty include: clinical-level evidence (even small human studies), improved production controls that deliver consistent molecular-weight distributions and activity, formulation technologies that solve taste/stability challenges, and increasing demand for verified, traceable, sustainable supply chains. For B2B buyers, the implication is clear: the supplier you choose must deliver science + manufacturability + commercial support, not only a price per kg.

Applications in Functional Nutrition: Where Bioactive Peptides Deliver Value

Peptides are already embedded across the functional-nutrition landscape:

- Clinical and medical nutrition: peptide-based enteral feeds for GI-compromised patients (e.g., peptide-based tube feeds that help absorption and tolerance). [2]

Commercial example: Nestlé Health Science’s Peptamen® family demonstrates the clinical utility of peptide formulas for patients with impaired digestion and absorption; this is a clear B2B success story where peptide technology enabled a differentiated medical product. [2] - Beauty & active lifestyle: collagen peptides positioned for skin and joint outcomes. Clinical, product-level positioning and evidence (peer-reviewed trials) turn collagen from a generic hydrolysate into a branded functional ingredient. Peptan® (Rousselot), for example, is marketed as a high-purity collagen peptide with supporting science and broad food/ supplement adoption. [3]

- Targeted outcomes supported by clinical data: patented collagen peptides such as VERISOL® (GELITA) show repeatable skin-health outcomes in human trials—an example of how clinical validation elevates a peptide from commodity to specialty. [4]

- Cardiometabolic positioning: milk-derived lactotripeptides (VPP/IPP) have been linked to modest blood-pressure reduction in multiple studies; these peptides became commercial ingredients in fermented/dairy products with health claims in select markets—another model of evidence-driven differentiation. [5]

Key takeaway for B2B: Use case and clinical evidence make the difference. For procurement and marketing teams, prioritize suppliers who can align peptide molecular profile, dose, and stability with your product’s intended claims and regulatory pathway.

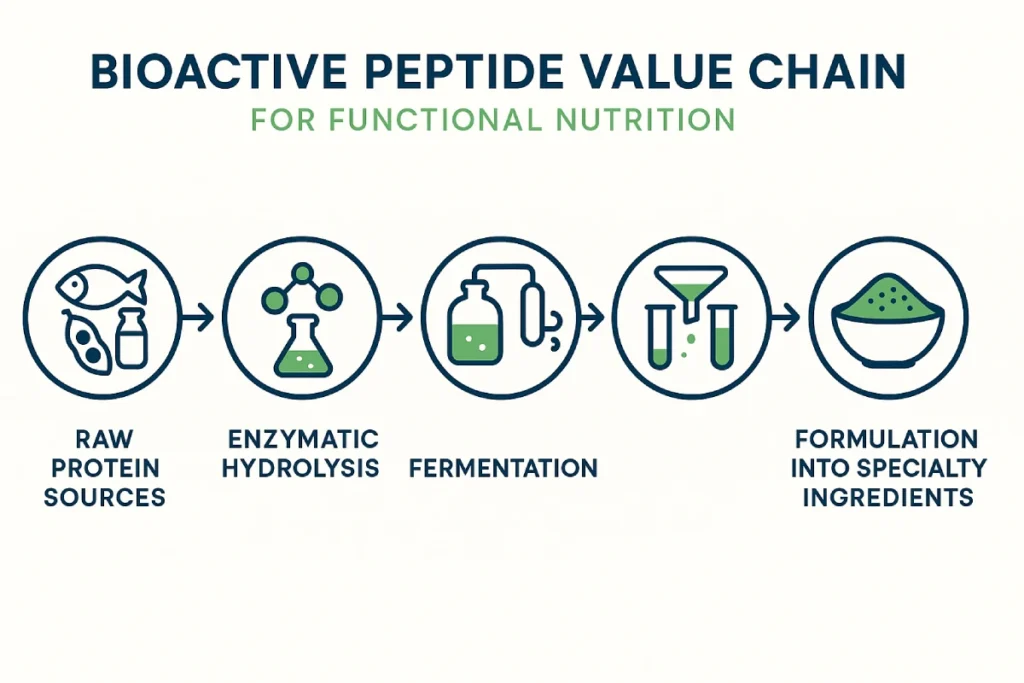

Mapping the Bioactive Peptide Value Chain: From Protein Source to Specialty Ingredient

To convert a peptide from commodity to specialty you must control—and optimize—every node in the value chain:

- Protein source selection (raw material strategy)

- Consider protein composition, seasonal variability, sustainability profile and cost. Plant, dairy, marine and microbial sources each offer distinct peptide repertoires.

- B2B action: Specify source acceptance criteria (moisture, protein content, contaminant limits) and require supplier traceability and COA transparency.

- Hydrolysis & enzyme strategy (manufacturing know-how)

- Enzyme choice, hydrolysis time, pH and temperature define the peptide fingerprint (molecular-weight distribution and sequence hotspots). Controlled multi-step enzymology or targeted protease cocktails often yield higher-value, predictable bioactives.

- B2B action: Request process maps and batch-level peptide profile data (e.g., SEC/UPLC molecular-weight distribution, LC-MS fingerprints).

- Fractionation & purification (grade differentiation)

- Ultrafiltration, chromatography and membrane fractionation can concentrate active fractions, enabling higher potency and a clearer claim path. This is where commodity hydrolysate becomes a specialty ingredient.

- B2B action: Compare activity per mg, not just purity %—ask for activity assays (in vitro, ex vivo) and analytical data.

- Stability & formulation (application engineering)

- Taste, solubility, pH tolerance, and shelf stability determine whether an ingredient will integrate smoothly into beverages, powders, capsules or medical formats. Encapsulation, microencapsulation, or complexation with carriers can mitigate flavor and stability issues.

- B2B action: Demand application data (pilot runs in target matrix) and sensory reports.

- Quality systems & regulatory readiness

- GMP, HACCP, contaminant controls, allergen management and paperwork (COA, stability, safety dossiers) are table stakes for B2B markets across regions. For medical nutrition and regulated claims, clinical/ toxicology packages are required.

- B2B action: Align supplier audit calendars, require third-party lab verification when entering new markets.

- Scale economics & supply security

- Specialty positioning can command higher price per kg—but must be scalable. Consider supplier capacity, multi-source strategies and long-lead inventories.

- B2B action: Negotiate staged volume commitments, and include clauses for supply continuity.

PEPDOO® position: As a full-range peptide manufacturer, PEPDOO® offers end-to-end capabilities across these nodes—raw sourcing, patented small-molecule peptide technologies, multi-enzyme hydrolysis and fermentation processes, and downstream fractionation—making it a practical partner for B2B brands that need both technical depth and supply reliability.

Strategies for B2B Brands: Moving from Commodity to Specialty

If your brand, R&D team or procurement function wants to extract more value from peptide ingredients, pursue these levers:

- Select function-first ingredients

- Prioritize ingredients with a clear mechanism, dose/response data, and manufacturability. A more expensive, clinically validated peptide can reduce time-to-claim and increase conversion.

- Co-develop to lock in differentiation

- Joint development agreements, exclusive fractions or co-branding accelerate commercial differentiation. Request pilot-scale runs and sensory/formulation support as part of the scope.

- Invest in targeted clinical validation

- Even small, well-designed human trials (n=30–100) tailored to your product claim can multiply commercial value. Partner with suppliers who can support trial design and supply GMP material.

- Optimize formulation & delivery

- Work on dose delivery (microdosing, encapsulation), taste masking and compatibility with your active matrix. Formulator time saved equals faster product launches.

- Use content & SEO to tell a technical story

- For B2B channels, publish white papers, mechanism-of-action briefs, case studies and regulatory dossiers. Keywords to prioritize: bioactive peptide manufacturer, custom peptide solutions, functional peptides, peptide supplier, peptide factory. These will help procurement and R&D discover you during vendor due diligence.

PEPDOO® value add: PEPDOO® provides joint R&D, sample libraries, pilot production and dossier support—so brands can move faster from concept to market while preserving IP and claim differentiation.

Quality, Safety & Regulatory Pathways for Bioactive Peptides

Quality and regulatory readiness are the backbone of specialty positioning:

- Analytical expectations: molecular-weight distribution, peptide sequence mapping (LC-MS/MS), residual enzyme levels, microbial limits, heavy metals and allergen testing.

- Quality systems: supplier must operate under GMP and be able to support third-party audits and provide full traceability.

- Claims and regulations: product classification (dietary supplement, food, medical food, enteral nutrition) defines permissible claims and dossier needs; different jurisdictions (EU, US FDA, China NMPA) have unique expectations.

- Safety evidence: depending on claim and dose, suppliers may need subchronic toxicology, allergenicity assessment, and human tolerance data.

Commercial example: Companies that paired regulated product formats with peptide science—such as medically oriented peptide feeds—were able to command differentiated market positions and premium pricing while meeting stringent regulatory scrutiny. Nestlé’s peptide-based Peptamen is a commercial illustration of how peptides enable differentiated clinical nutrition products. [2]

Key takeaway for procurement & regulatory teams: define regulatory target early, and require supplier dossiers aligned to that target before scale-up.

Future Outlook: Innovations & Collaboration Opportunities

The next phase of peptide specialization will be driven by three trends:

- AI-assisted peptide design and peptidomics — in silico screening and ML models accelerate candidate discovery and sequence prioritization. [5]

- Sustainable, non-food animal peptide sources — marine by-products and fermentation routes reduce environmental footprint and open new functional profiles.

- Formulation & delivery innovation — advanced encapsulation and targeted release make higher-dose or sensitive peptides practical in consumer formats.

For B2B companies: prioritize partners who are investing in these areas and can provide not only material but also a roadmap for innovation.

PEPDOO® forward focus: PEPDOO® is actively investing in novel small-molecule peptide IP, multi-enzyme/fermentation hybrid processes, and application-led formulation services to help partners explore AI-enabled design and sustainable sourcing.

Transform Your Functional Nutrition Products with PEPDOO®’s Specialty Peptides

Turning bioactive peptides from a commodity into a specialty ingredient requires integrated thinking across sourcing, process engineering, analytics, formulation and regulatory strategy. For B2B buyers—procurement, R&D and marketing—the supplier selection is strategic: choose partners who can provide reproducible data, application engineering and regulatory support, not only a low unit price.

PEPDOO® positions itself as that partner: a full-range peptide manufacturer, a contributor to China’s peptide industry standards, and a leader in patented small-molecule peptide technologies—ready to co-develop, scale and certify specialty peptide solutions for global functional-nutrition and medical-nutrition customers.

Partner with PEPDOO® for Specialty Peptide Solutions

Discover how PEPDOO®, a full-range peptide manufacturer and China’s leading innovator in small-molecule peptides, can help your brand accelerate product development with customized peptide solutions, pilot samples, and regulatory support.

Contact UsFAQ

Specialty peptides are differentiated by controlled molecular profiles, clinical evidence, consistent manufacturing processes, and formulation compatibility. They provide verifiable functional benefits, unlike commodity hydrolysates which vary batch-to-batch.

PEPDOO® offers end-to-end support: raw material sourcing, patented small-molecule peptide technologies, multi-enzyme hydrolysis, fermentation processes, downstream fractionation, pilot trials, and regulatory dossiers—helping brands accelerate from concept to market.

Yes. B2B clients can co-develop peptides targeting skin, joint, cardiometabolic, immune, or gut health outcomes. Custom hydrolysis pathways and fractionation enable tailored molecular-weight distributions and bioactive profiles suitable for your application.

PEPDOO® operates under GMP and HACCP, maintains full traceability, provides COAs for every batch, and supports regulatory documentation aligned with global standards (FDA, NMPA, EFSA) for functional foods, dietary supplements, and medical nutrition products.

PEPDOO® offers scalable production, multi-source raw material strategy, inventory planning, and long-term supply agreements. This ensures consistent availability for B2B clients across global markets.

Yes. Examples include Nestlé’s Peptamen® peptide-based medical nutrition formulas, Rousselot’s Peptan® collagen peptides in beauty & active nutrition, and GELITA’s VERISOL® clinical evidence-based skin peptides. PEPDOO® partners similarly support B2B clients with technical dossiers and pilot studies.

References

- Smith, J., & Lee, A. (2024). Exploring the potential of bioactive peptides: from natural sources to functional characterization. Frontiers in Peptide Science.

- Nestlé Health Science. (n.d.). Peptamen – Enteral nutrition solution. Nestlé Health Science.

- Rousselot / Peptan. (2024). Peptan® collagen peptides — product information. Peptan.

- GELITA. (n.d.). VERISOL®: clinical evidence for skin hydration and elasticity. GELITA.

- Cicero, A. F. G., & Colletti, A. (2013). Do the lactotripeptides isoleucine–proline–proline (IPP) and valine–proline–proline (VPP) reduce blood pressure? Nutrients / Physiological Reviews.