Global Demand for Functional Peptides

Functional peptides are bioactive compounds widely used in functional foods, nutraceuticals, and medical nutrition products, providing benefits such as improved gut health, anti-aging effects, immune modulation, and metabolic support. The global functional peptide market is growing rapidly, driven by increasing consumer awareness of health and wellness, a rising aging population, and advancements in peptide extraction and synthesis technologies [1].

The Asia-Pacific (APAC) and European Union (EU) markets represent two of the most dynamic regions in the functional peptide sector. Understanding the differences in consumer preferences, regulatory frameworks, and sourcing trends is crucial for B2B stakeholders—including functional food, dietary supplement, and medical nutrition brands—to make informed decisions.

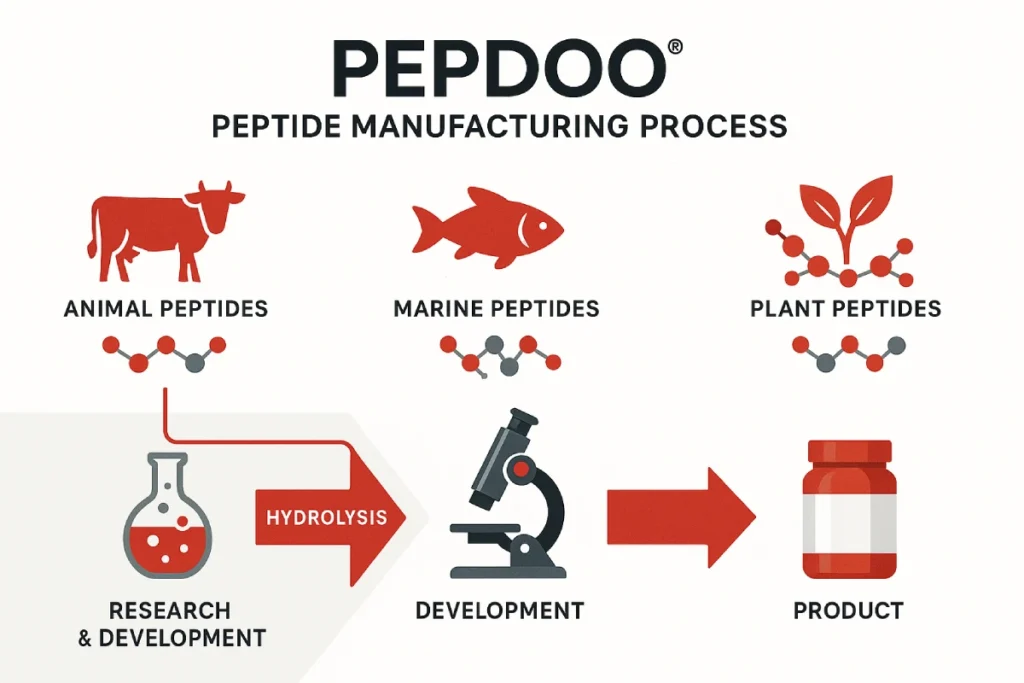

As a leading full-range peptide manufacturer, PEPDOO® is a key player in this space. We are a Chinese industry standard setter for peptide categories, hold one of the largest portfolios of small-molecule peptide patents in China, and leverage internationally advanced peptide production technologies to support global brands in launching innovative functional products.

Global Functional Peptides Market Overview

The functional peptide market has experienced strong growth globally. According to Data Bridge Market Research (2023), the bioactive peptides market was valued at USD 4.96 billion in 2022 and is expected to reach USD 10.71 billion by 2030, with a compound annual growth rate (CAGR) of 10.1% [2].

These peptides are increasingly integrated into sports nutrition, skin health supplements, immune boosters, and medical nutrition formulations. The rise of lifestyle diseases and increasing longevity further intensifies demand. For B2B buyers, this represents opportunities to source innovative peptide blends and functional ingredients that differentiate their products in crowded markets.

Success Case: A global sports nutrition brand in APAC collaborated with PEPDOO® to develop a plant-based peptide blend, achieving a 30% increase in product sales within 12 months while meeting local regulatory requirements.

Functional Peptides in APAC: Drivers, Trends, and Regulatory Environment

Consumer Drivers in APAC

In APAC, consumers are increasingly health-conscious, seeking products that promote wellness, beauty, and longevity. Countries like China, Japan, and South Korea have a strong tradition of functional foods, which is now expanding to emerging markets such as India, Malaysia, and Indonesia [3].

Market Trends

- Collagen peptides dominate the beauty and skincare segment. The APAC collagen peptide market is projected to grow at a CAGR of 6.1% over the next five years (Mordor Intelligence, 2024).

- Plant-based peptides are rising due to growing vegan and vegetarian populations.

- Functional peptides are also increasingly used in immune health formulations and sports nutrition powders.

Success Case: A Japanese functional beverage brand partnered with PEPDOO® to create a low-molecular-weight fish peptide drink. Within six months of launch, the product ranked among the top 10 best-selling items on multiple APAC e-commerce platforms.

Regulatory Environment

- China: Regulated by the National Health Commission (NHC) under the Health Food Law; peptide ingredients must meet safety and efficacy requirements.

- Japan: The Consumer Affairs Agency (CAA) approves “Foods for Specified Health Uses” (FOSHU), including peptide-based supplements.

- South Korea: The Ministry of Food and Drug Safety (MFDS) oversees functional ingredient approvals.

For B2B buyers, navigating APAC regulations is critical. PEPDOO®, as a full-range peptide manufacturer with extensive regulatory expertise, supports clients in achieving compliance while accelerating time-to-market.

Functional Peptides in EU: Quality Standards and Market Opportunities

Consumer Drivers in EU

EU consumers increasingly demand high-quality functional peptides for benefits such as joint support, skin elasticity, metabolic health, and healthy aging. There is also heightened interest in clean-label products, sustainable sourcing, and clinically validated ingredients [4].

Market Trends

- The EU collagen peptide market is projected to grow from USD 204.1 million in 2025 to USD 336.7 million by 2035 (Future Market Insights, 2024).

- Marine-based peptides are particularly sought after in the cosmetics and nutraceutical industries.

- Brands focus on clinically substantiated formulations to meet consumer expectations.

Success Case: A French medical nutrition company collaborated with PEPDOO® to develop a multi-peptide nutrition powder. The product successfully passed EFSA health claim assessments and gained acceptance in hospital distribution channels.

Regulatory Environment

- EFSA Health Claims: Peptide products must have evidence-based health claims approved by the European Food Safety Authority.

- Food Safety Compliance: EU products must adhere to the General Food Law Regulation and certifications such as ISO, GMP, and FSSC 22000.

- Traceability & Sustainability: Increasingly, brands demand suppliers provide full traceability and environmentally responsible sourcing.

With PEPDOO®’s advanced production technologies, B2B brands can meet EU’s stringent compliance requirements while differentiating their functional peptide products.

APAC vs EU Market Comparison: Key Differences

| Aspect | APAC | EU |

|---|---|---|

| Market Growth Rate | High | Stable, mature |

| Popular Applications | Sports nutrition, immune modulation | Medical nutrition, healthy aging |

| Consumer Drivers | Health-conscious, beauty-focused | Evidence-based, sustainable, clean-label |

| Regulatory Requirements | Diverse, region-specific | Strict, standardized |

| Supplier Considerations | Speed, innovation, cost-effectiveness | Compliance, clinical validation, quality |

PEPDOO® Advantage: As a full-range peptide manufacturer and Chinese industry standard setter, PEPDOO® provides globally patented small-molecule peptides and internationally advanced production technologies, making it an ideal partner for cross-regional strategies.

Strategic Insights for B2B Buyers & R&D Teams

- Product Adaptation: Customize peptide formulations according to regional health trends and consumer preferences.

- Supplier Selection: Prioritize regulatory compliance, R&D capability, and sustainable sourcing.

- Cross-Regional Strategies: Leverage APAC’s manufacturing speed and EU’s high compliance standards for global product launches.

Success Case: A multinational nutraceutical company adopted a cross-regional sourcing model with PEPDOO®, combining APAC rapid production with EU regulatory compliance, achieving synchronized launches in multiple markets.

Market Insights & Next Steps for B2B Functional Peptides

Understanding APAC vs EU functional peptide markets is critical for B2B stakeholders seeking growth in functional nutrition. While APAC offers rapid growth and innovative opportunities, EU emphasizes quality, compliance, and clinically validated ingredients. Partnering with PEPDOO® enables brands to navigate these regional differences, access patented peptides, and leverage cutting-edge production technologies for market success.

FAQ

Functional peptides can be classified by source and functionality:

- Collagen peptides: skin, joint, and bone health products.

- Marine peptides: high bioactivity, suitable for nutraceuticals and medical nutrition.

- Plant-based peptides (soy, pea, rice): ideal for vegan and clean-label functional foods.

- Oyster and animal peptides: commonly used for immune and metabolic health supplements.

Choosing the right peptide depends on your target health benefit, regulatory environment, and consumer preference.

- Work with suppliers who understand regional regulations (e.g., EFSA in EU, NHC in China, MFDS in Korea).

- Request full documentation for safety, efficacy, and certifications (ISO, GMP, FSSC 22000).

- Partner with experienced manufacturers like PEPDOO® to leverage compliance expertise and international standards.

Yes. Many B2B brands require custom peptide blends for functional foods, nutraceuticals, or medical nutrition. Customization can include:

- Peptide type and source selection

- Molecular weight adjustment for bioavailability

- Specific functional combinations (e.g., collagen + plant peptides)

- Flavor and solubility optimization for beverage or powder applications

PEPDOO® provides full-range customization and supports cross-regional product launches.

- APAC: Focus on cost-efficiency, fast product iteration, and innovative peptide blends.

- EU: Emphasize strict compliance, clinical evidence, traceability, and clean-label requirements.

- Brands often combine APAC manufacturing speed with EU compliance for global launches, a model supported by PEPDOO®.

Working with a supplier like PEPDOO® provides:

- Access to a wide variety of peptides (animal, marine, plant)

- Patented small-molecule peptides with proven bioactivity

- Regulatory and compliance support across regions

- Custom formulations tailored to brand needs

- Advanced international peptide manufacturing technologies

References

- Data Bridge Market Research. (2023). Bioactive peptides market report 2023–2030.

- Future Market Insights. (2024). Europe collagen peptides market forecast 2025–2035.

- Mordor Intelligence. (2024). Asia-Pacific collagen peptide market growth outlook.