Asia-Pacific’s Nutricosmetics Boom: The Rise of Beauty Peptides

In the rapidly expanding nutricosmetics sector, Asia-Pacific (APAC) stands out as a global growth engine. Consumers across the region are increasingly turning to ingestible beauty supplements that promise skin radiance, elasticity, and overall youthfulness. At the core of this shift lies a powerhouse category of ingredients: beauty peptides. From collagen peptides to botanical oligopeptides, these functional ingredients are redefining the concept of skincare—from topical to within.

As a source manufacturer and full-spectrum functional peptide supplier, PEPDOO® has witnessed a dramatic uptick in demand for tailored peptide ingredients across the Asia-Pacific market. In this article, we explore the major trends, consumer insights, regulatory updates, and innovation strategies shaping the region’s dynamic beauty-from-within landscape.

The Beauty-From-Within Market in APAC: Accelerating Growth

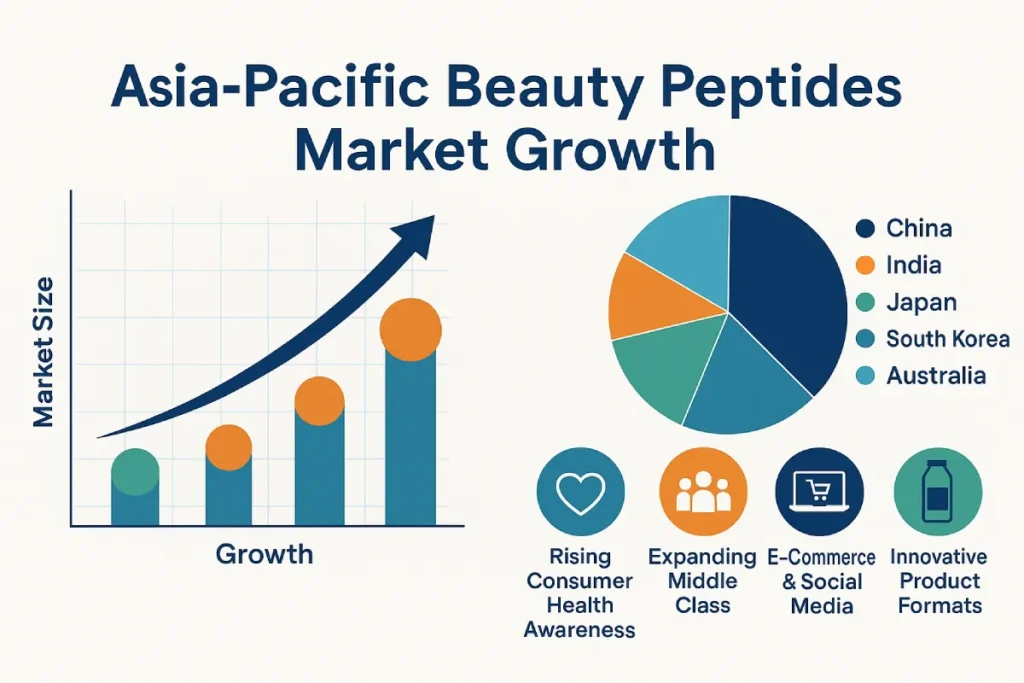

Asia-Pacific dominates the global nutricosmetics landscape, accounting for over 35% of the market share in 2024. The region is forecasted to grow at a CAGR of 8.9% through 2030, driven by rising consumer awareness, aging populations, and the growing convergence between food, supplements, and skincare [1].

Beauty peptides—especially marine collagen peptides and plant-based bioactive peptides—have emerged as the leading functional ingredients in this category. Consumers now seek more than just collagen; they look for peptides with targeted skin benefits such as hydration, anti-photoaging, skin barrier support, and even pigmentation control.

Country-Level Insights: Local Trends, Global Impact

Understanding APAC’s diversity is key for any brand or OEM entering this space. The following markets show distinct consumer behaviors and regulatory environments:

China

China is the single largest market in APAC for beauty-from-within products. Gen Z consumers are fueling demand through livestream e-commerce platforms, with a strong preference for skin-firming collagen powders, gummies, and ready-to-drink formats [2]. Products with CFDA-compliant Blue Hat approval enjoy premium positioning and consumer trust.

Japan

Japan continues to be a pioneer in the collagen peptide market, with deep consumer familiarity dating back to the early 2000s. Functional claims under the Foods for Specified Health Uses (FOSHU) system add credibility, while Japanese consumers expect highly bioavailable peptide formats such as dipeptides and tripeptides [3].

South Korea

K-beauty culture has expanded into ingestibles, with celebrity endorsements and influencer-driven campaigns. Korean consumers prefer minimalist, clean-label peptide formulas, often paired with hyaluronic acid or vitamin C. The MFDS regulates these as health functional foods.

Southeast Asia & India

Markets such as Indonesia, Vietnam, and Thailand are witnessing rapid uptake of beauty supplements, especially among urban millennials. In India, the fusion of Ayurveda and peptides has given rise to new formulations targeting inner glow and detoxification, governed by FSSAI guidelines [4].

Consumer Demands Are Evolving: Function Meets Identity

Today’s APAC consumers demand more than “beauty.” They want products that align with their lifestyle, values, and skin goals:

- Gen Z & Millennials prioritize visible results, clean labels, and convenience (e.g., stick packs, sachets).

- Male grooming segments are emerging, with interest in peptides that support skin resilience and post-shaving care.

- Active agers (50+) are seeking peptide combinations that address both skin and joint health.

Functional positioning around hydration, skin barrier integrity, elasticity, and even microbiome balance are trending. Sustainability and source transparency also strongly influence purchase decisions [5].

Ingredient Innovation: Bioactivity Beyond Collagen

While collagen peptides remain the dominant beauty peptide globally, brands in APAC are exploring a broader array of peptide types and delivery systems. Key innovations include:

- Marine collagen peptides from fish skin, scale, or jellyfish: low molecular weight (500–2,000 Da) for enhanced absorption.

- Plant-based peptides (soy, rice, pea, mung bean): supporting vegan, halal, and clean-label claims.

- Enzymatically optimized oligopeptides, including di- and tri-peptides: showing superior skin bioactivity and absorption kinetics.

- Advanced delivery technologies such as liposomal encapsulation, time-release beads, and heat-stable peptide matrices suitable for RTD formats.

At PEPDOO®, we offer over 100 types of functional peptide raw materials, covering a full spectrum of sources and functions—from marine and botanical to animal and fermentation-derived peptides. Each is developed with precision enzymatic hydrolysis for consistent bioavailability, purity, and performance. Our in-house R&D and manufacturing capabilities empower brands and OEMs to create next-generation beauty supplements with scientifically backed efficacy.

Regulatory Landscape: Fragmented but Fast-Evolving

The regulatory environment across APAC remains highly localized:

- China’s CFSA maintains the Blue Hat registration system for functional foods, with peptide ingredients requiring clinical backing and origin traceability.

- Japan’s FOSHU and FFC systems govern health claims in food products.

- Australia’s TGA classifies ingestible peptides as complementary medicines.

- ASEAN countries are moving toward harmonized supplement labeling but currently enforce diverse local rules.

B2B buyers are increasingly looking for technical dossiers, safety evaluations, and label-claim substantiation from their suppliers—a demand that source manufacturers like PEPDOO® are well-positioned to meet.

Supply Chain & Source Transparency: The OEM Perspective

As a source manufacturer, PEPDOO® offers complete transparency from raw material procurement (marine, bovine, plant) to final hydrolyzed peptide powder. Brands and OEM clients benefit from:

- Traceable sourcing, including upcycled fish by-products and BSE-free bovine collagen.

- GMP-compliant production and ISO certifications.

- Custom peptide design, including molecular weight adjustment and bioactivity testing.

This upstream control reduces variability, improves quality assurance, and accelerates time to market for APAC brand launches.

Market Access & Channel Dynamics

APAC’s beauty peptide boom is fueled by diverse go-to-market strategies:

- Cross-border e-commerce via Tmall Global, Shopee, Rakuten, and Lazada enables regional reach.

- Social commerce and KOL marketing dominate in China and Southeast Asia, with influencers playing a central role in product discovery.

- Pharmacies and clinics are emerging as high-trust offline channels for premium peptide SKUs.

Flexible packaging formats such as sachets, mini-bottles, and powder capsules support omnichannel merchandising and trial-based marketing.

Opportunities & Challenges for B2B Players

| Opportunities | Challenges |

|---|---|

| Vegan/plant peptides for clean-label and halal positioning | Regulatory complexity across markets |

| Male-targeted nutricosmetics | Peptide price sensitivity |

| Beauty + Joint/Mobility combo formulations | Need for clinical validation |

| Biotech-derived fermentation peptides | IP protection and imitation risks |

Future Outlook: 2026–2030

The APAC beauty peptide market is forecasted to reach $6.2 billion by 2030, with functional RTD beverages, gummies, and stick packs as top-performing formats [6]. M&A activity is expected to accelerate, particularly in the contract manufacturing space.

Peptide personalization, sustainability storytelling, and clinical validation will define next-generation winners.

Strategic Recommendations for Brands and OEMs

- Work with source manufacturers to secure traceable, high-purity peptide raw materials.

- Diversify peptide portfolios beyond collagen—include plant peptides, joint + skin blends, and fermented bioactives.

- Leverage consumer education: highlight science-backed results, peptide sequences, and low MW.

- Invest in format innovation (RTD beauty drinks, jelly shots) tailored to local preferences.

- Stay regulation-ready with technical dossiers, GRAS-equivalence data, and real-time ingredient traceability.

Conclusion: Partnering for Peptide Innovation

The Asia-Pacific beauty-from-within market presents an unparalleled opportunity for brands and ingredient buyers focused on skin wellness, functional nutrition, and innovation. At PEPDOO®, we combine R&D excellence, source-level transparency, and a comprehensive peptide portfolio to help B2B partners develop next-generation beauty products with proven results.

Need a tailored beauty peptide solution for your next launch?

Contact our peptide innovation team for samples, dossiers, or feasibility support —

reply guaranteed within 24 hours.

FAQ

Beauty peptides are short chains of amino acids that act as functional ingredients to promote skin health and appearance. Common types include collagen peptides and botanical oligopeptides, widely used in both topical skincare and ingestible beauty supplements.

Rising consumer health awareness: Increasing demand for products supporting beauty-from-within concepts.

Expanding middle class: Growth of affluent consumers in countries like China and India drives premium product demand.

E-commerce and social media influence: Online platforms accelerate product discovery and adoption.

Innovative product formats: Novel delivery forms such as collagen drinks and gummies attract younger consumers.

Key markets include China, India, Japan, South Korea, and Australia, all of which play significant roles in consumption, production, and innovation within this sector.

Skin care: Anti-aging, skin brightening, elasticity improvement.

Hair care: Promoting hair growth and strengthening.

Nail care: Enhancing nail strength and shine.

Lack of unified quality standards: Variability in regulatory requirements across countries impacts market entry.

Consumer education gaps: Limited awareness about peptides and their benefits among some consumer segments.

Intense market competition: Increasing number of brands vying for market share.

Growing demand for personalized products: Customized peptide formulations tailored to individual needs.

Rise of plant-based peptides: Natural and sustainable peptides gaining popularity.

Technology-driven innovation: Advances such as AI-assisted peptide design and nanotechnology-enabled delivery systems.

References

- Euromonitor International. (2024). Asia-Pacific Nutricosmetics Market Outlook 2024–2030.

- Deloitte China. (2024). Beauty From Within: Consumer Trends in Functional Foods.

- Mintel Japan. (2023). Collagen Peptide Innovation and FOSHU Approvals.

- FSSAI India. (2023). Functional Foods and Peptides Guidelines.

- Innova Market Insights. (2024). Top 10 Trends in Nutricosmetics: Skin, Sustainability, and Science.

- Grand View Research. (2024). Beauty Supplements Market Size and Forecast, 2024–2030.